- HISD Human Resources

- Frequently Asked Questions

Employee Services

Page Navigation

Frequently Asked Questions

Direct Deposit

-

How can I update my direct deposit data?

How to Update Your Direct Deposit Information

If you need to update your direct deposit details with the Houston Independent School District (HISD), you can do so through one of the following methods:

Option 1: In-Person at the Human Resources Lobby

- Visit: Go to the Human Resource office at the Hattie Mae White Educational Building located at:

- Address: 4400 West 18th Street, Houston, Texas 77092

- Complete a Direct Deposit Form: Staff will provide the form for you to fill out.

- Provide Supporting Documentation: You will need to submit either:

- A voided check, or

- A direct deposit form from your banking institution, showing both the routing and account numbers.

Option 2: Email Submission

- Prepare Supporting Documents: Refer to the checklist below to ensure you have all necessary documentation.

-

Email Submission: From your HISD email, scan and send the completed direct deposit form along with required documents to:

- Leonor Corona at Leonor.Corona@houstonisd.org and

- Payroll Department at Payroll@houstonisd.org.

-

Direct Deposit Checklist:

- Full Name

- Social Security Number

- HISD Employee ID Number

- Date of Birth

- Current Address

- Department Name/School

- Manager/Principal Name

- Old Bank Details (if changing existing account)

- Copy of your Driver’s License

- Copy of your HISD ID card

- Voided check or direct deposit form from your bank showing routing and account numbers

For either option, ensure that all documentation is accurate and complete to avoid delays in processing.

- Visit: Go to the Human Resource office at the Hattie Mae White Educational Building located at:

-

I currently have one account on file for direct deposit and would like to add an additional account. What steps will I need to take?

Adding an Additional Direct Deposit Account

If you would like to add an additional account for direct deposit, please follow one of the options below:

Option 1: In-Person Submission

- Visit the Human Resources Lobby: Go to the Hattie Mae White Educational Building at:

- Address: 4400 West 18th Street, Houston, Texas 77092

- Complete a Direct Deposit Form: Staff will provide you with the form to fill out.

- Submit Supporting Documentation: Bring a voided check or a direct deposit form from your bank that includes the routing and account numbers for the new account.

Option 2: Email Submission

- Complete the Direct Deposit Form: Fill out the form with the details of the additional account.

- Prepare Supporting Documents: Attach a voided check or a direct deposit form from your bank that confirms the new account's routing and account numbers.

- Send from Your HISD Email: Email the completed form and supporting documents to Payroll@houstonisd.org for processing.

For both options, please ensure all information is accurate to prevent any delays in processing.

- Visit the Human Resources Lobby: Go to the Hattie Mae White Educational Building at:

-

How many accounts am I able to identify for direct deposit?

Maximum Number of Accounts for Direct Deposit

Employees may designate up to three accounts for direct deposit.

If you wish to add or modify accounts, please follow the steps outlined for adding additional accounts to ensure smooth processing.

-

I requested a pay card during onboarding. How will the pay card be distributed to ensure access to my payable time?

Distribution of Pay Cards for Access to Payable Time

If you request a pay card during onboarding, it will be sent to your home address on file via our third-party vendor, Wisely (www.mywisely.com).

Please Note: If you do not receive your pay card at least two business days before HISD’s bi-weekly payroll date, you may visit the Human Resources Lobby to obtain a temporary pay card.

- Location: Hattie Mae White Educational Building

- Address: 4400 West 18th Street, Houston, Texas 77092

The Payroll Department will issue a temporary pay card to ensure you have timely access to your wages.

- Location: Hattie Mae White Educational Building

Pay Issues

-

How is my gross pay determined?

Determination of Gross Pay

An employee's gross pay is calculated based on their annual salary, divided by 26 pay periods (in most cases). This amount reflects earnings before taxes and deductions.

- Standard Calculation: Annual salary ÷ 26 pay periods.

- Prorated Calculation: If an employee starts after the scheduled start date, the annual salary will be adjusted (prorated) based on the hire date.

This ensures that the gross pay accurately reflects the portion of the annual salary earned within the employment period.

-

How can I receive a copy of my pay statement?

Retrieving a Copy of Your Pay Statement as an Inactive Employee

As an inactive employee, you have two options to obtain copies of your pay statements:

Option 1: In-Person at the Hattie Mae White Building

- Visit the Employee Services Department: Go to the Hattie Mae White Building at:

- Address: 4400 West 18th Street, Houston, Texas 77092

- Request Your Pay Statements: The Employee Services team, located in the Human Resources office, can provide you with up to four pay statements at a time.

Option 2: Online Request

- Visit the HISD HR Help Portal: Go to www.houstonisd.org/hrhelp.

- Submit a Request: Select the "Request Pay Statement" option and complete the online form.

- Processing and Delivery: Once processed, the Employee Services team will either email your pay statements or mail them to the address on file.

Both options provide secure access to your pay statements to ensure you receive the documentation needed.

Viewing and Copying Your Pay Statement as an Active Employee

Active employees can view and copy their pay statements through the OneSource Employee Self-Service (ESS) portal.

- Log into OneSource: Access the Employee Self-Service (ESS) section.

- Select “Pay Statement”: Choose the pay statement option to view and copy your most recent pay statement.

- Availability: Upcoming pay statements are accessible beginning at 12:00 a.m. on Sunday of the payroll week.

This ensures convenient and timely access to your pay information.

- Visit the Employee Services Department: Go to the Hattie Mae White Building at:

-

What is Pay Per Escrow Account?

Pay Per Escrow Account

A Pay Per Escrow Account is an account where a portion of an employee’s earnings is set aside each paycheck to cover pay during the summer break.

- Purpose: Ensures employees receive a consistent gross amount per paycheck, even during periods when they are not actively working (e.g., summer).

- How It Works: The escrow amount is deducted from each paycheck and held to provide income during non-working months, such as summer, for employees on a contract schedule.

This approach provides stable income across the year for employees who do not work year-round.

-

What is Pay Per Escrow Payout?

Pay Per Escrow Payout

A Pay Per Escrow Payout is the disbursement of escrowed funds to ensure employees receive a consistent paycheck, even during unpaid holiday periods.

How It Works:

- Employees who are not directly paid for holidays have a portion of their earnings withheld and set aside (escrowed) from each paycheck.

- During holiday periods, funds from the escrow balance are released to maintain a consistent pay schedule.

- This process ensures the employee receives 1/26 of their annual salary per pay period, preventing gaps in income.

This system helps employees maintain steady earnings throughout the year, even when they are not actively working on holidays.

-

How can I opt out of escrow?

Please click on the following link for instructions on how to opt out of escrow.

-

Why Is There a TRS Deduction on My Paycheck?

The Teacher Retirement System (TRS) is a state-managed pension program for public education employees. Your paycheck includes a TRS deduction because you are contributing to your retirement benefits.

Key Reasons for TRS Deductions:

- Mandatory Contribution: As a public education employee, you are required to contribute a percentage of your salary to TRS to fund your retirement benefits.

- Retirement Security: TRS provides pension benefits upon retirement, ensuring long-term financial stability.

- Alternative to Social Security: Depending on your position with HISD, you will either contribute to TRS or Social Security, but not both.

These deductions help fund your future pension, offering you financial security after retirement.

-

How can I confirm hours worked?

Confirming Hours Worked

Employees can verify their certified working hours through OneSource Employee Self-Service (ESS).

Steps to Confirm Hours Worked:

- Log into OneSource ESS.

- Navigate to the "Time & Leave" Tab.

- Select "Certified Working Time".

- A new window will open, displaying a timesheet with your planned working hours.

This allows employees to review and ensure the accuracy of their recorded work hours.

Personal Data

-

I am married and/or divorced how do I update my new last name ?

How to Update Your Last Name in the HISD System

To update your last name, you have two options:

Option 1: In-Person Submission

Visit the Hattie Mae White Educational Building and provide the following documents in person:

- Social Security Card (original, displaying the new name)

- Driver’s License or Government-Issued Photo ID (must display the new name)

- Official Court Document (if applicable, such as a marriage certificate or divorce decree showing the name change)

Note: All documents must reflect your new name. The original Social Security card is required; copies or receipts will not be accepted.

Option 2: Online Submission

- Log into OneSource Employee Self-Service (ESS).

- Under Contracts and Forms, select HR Documents.

- Choose the "Name Change" option and upload the appropriate documents:

- Social Security Card (original, displaying the new name)

- Driver’s License or Government-Issued Photo ID (must display the new name)

- Official Court Document (if applicable, such as a marriage certificate or divorce decree showing the name change)

Note: All documents must reflect your new name. The original Social Security card is required; copies or receipts are not accepted.

After submitting your request, you will receive an email confirmation that your name change request has been received.

-

How can I update my home address?

How to Update Your Home Address

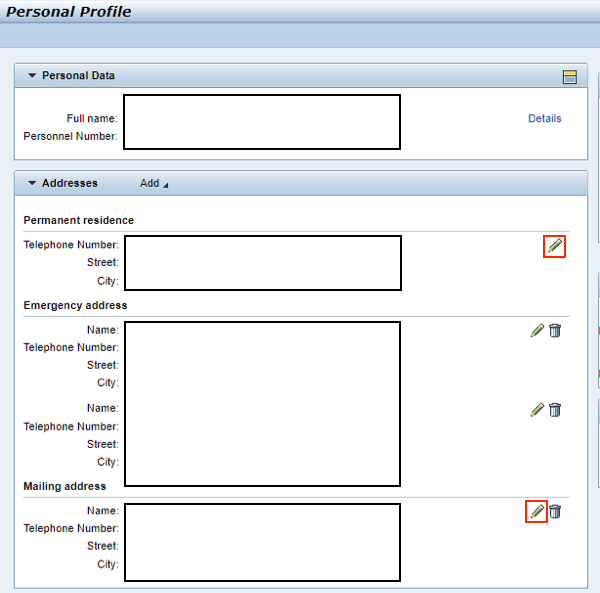

To update your home address, follow these steps:

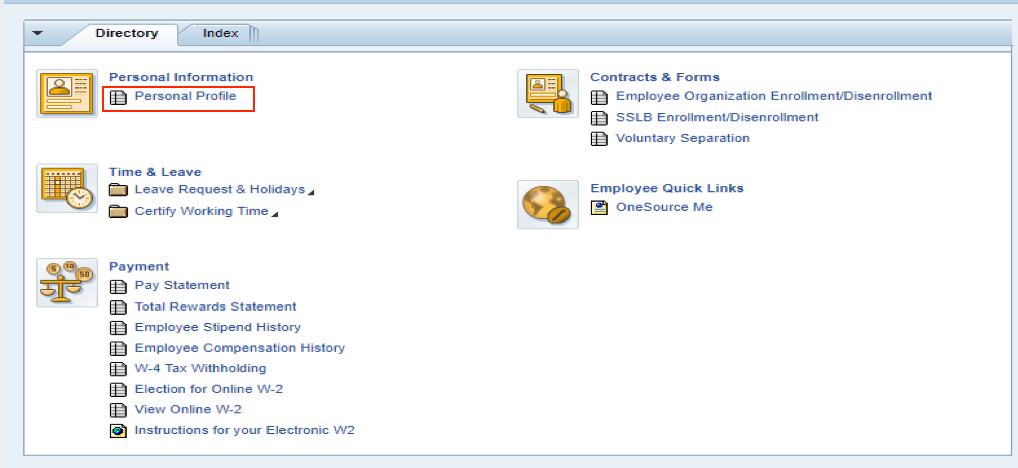

- Log into OneSource Employee Self-Service (ESS).

- Select the Personal Profile option.

- Click the pen icon to edit your address.

- Make the necessary changes and save the updated information.

Once completed, your address will be updated in the system accordingly.

For assistance, feel free to reach out to Employee Services.

-

My marital status and/or allowances are wrong. How can this be corrected?

How to Correct Your Marital Status and Allowances

Your marital status and allowances are based on the W-4 form you completed. To correct or update this information, follow these steps:

- Log into OneSource Employee Self-Service (ESS).

- Select the W-4 Tax Withholding option.

- Complete the necessary updates to your marital status and allowances.

- After submitting, the effective date of change will appear in the top left corner of the page.

-

How can I change my W4?

How to Change Your W-4

To update your W-4 tax withholding information, follow these steps:

- Log into OneSource Employee Self-Service (ESS).

- Select the W-4 Tax Withholding option.

- Make the necessary changes to your withholding preferences.

- Select the declaration to confirm your updates.

- Save your changes.

Once completed, the effective date of change will appear in the top left-hand corner of the page.

-

Requesting your W2

How do I retrieve my W-2 form?

If you are an active employee and selected the option to receive your W-2 by mail, your W-2 will be mailed to your current home address by January 31st.

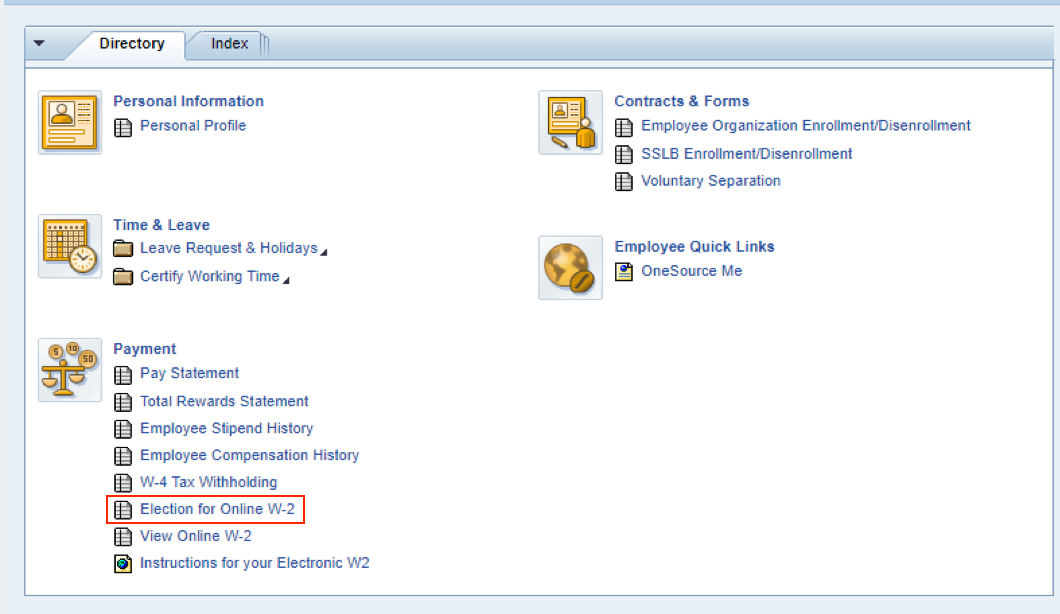

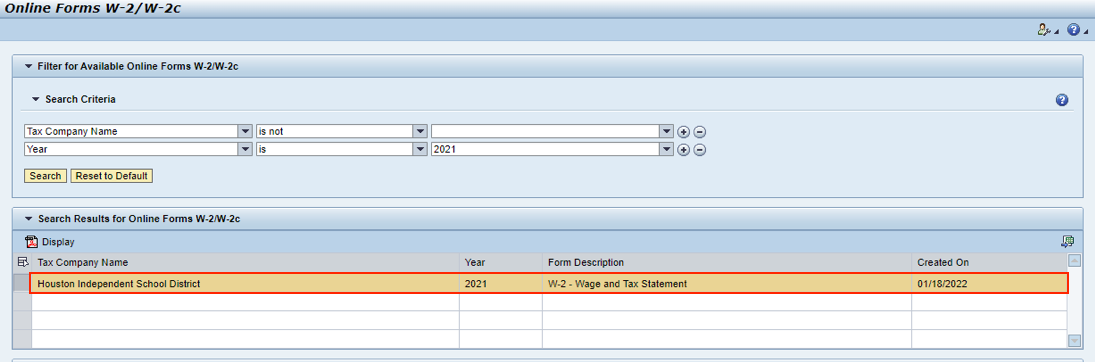

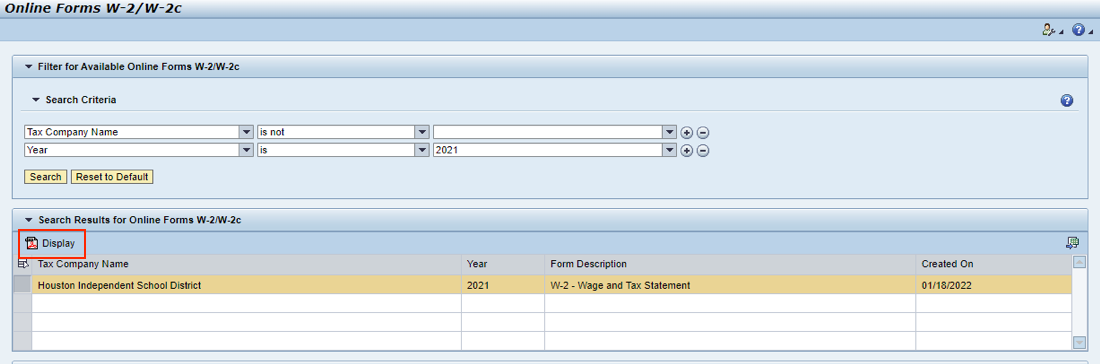

If you are an active employee and selected the option to retrieve your W-2 electronically, you can access your 2024 W-2 by following these steps:

- Log in to your Employee Self-Service (ESS) account by clicking the following link: HISD ESS.

- Once logged in, click on View Online W-2

- Select Houston Independent School District (Year) 2024 W-2 Wage and Tax Statement.

- Select Display.

- Your W-2 form will populate under the Display W-2/W2c tab. If your W-2 does not populate, try using a different web browser.

I am an active employee who requested my W-2 to be mailed; however, my address is incorrect. What steps should I follow to ensure my 2024 W-2 is mailed to me?

The deadline to update your current address to ensure receipt of your 2024 W-2 by mail by January 31, 2025, is January 17, 2025. If this deadline is missed, a reprint can be requested by following these steps:

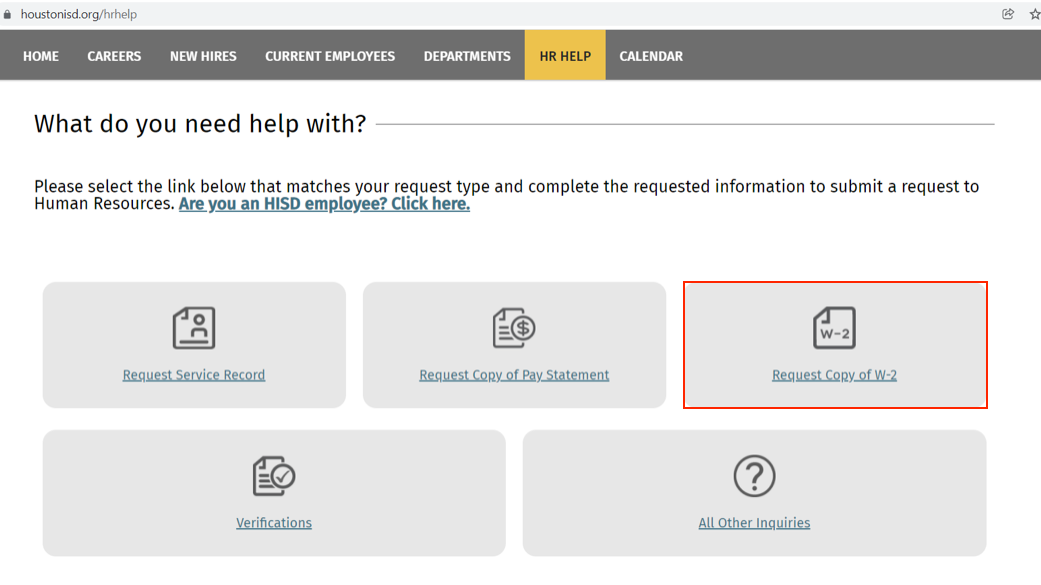

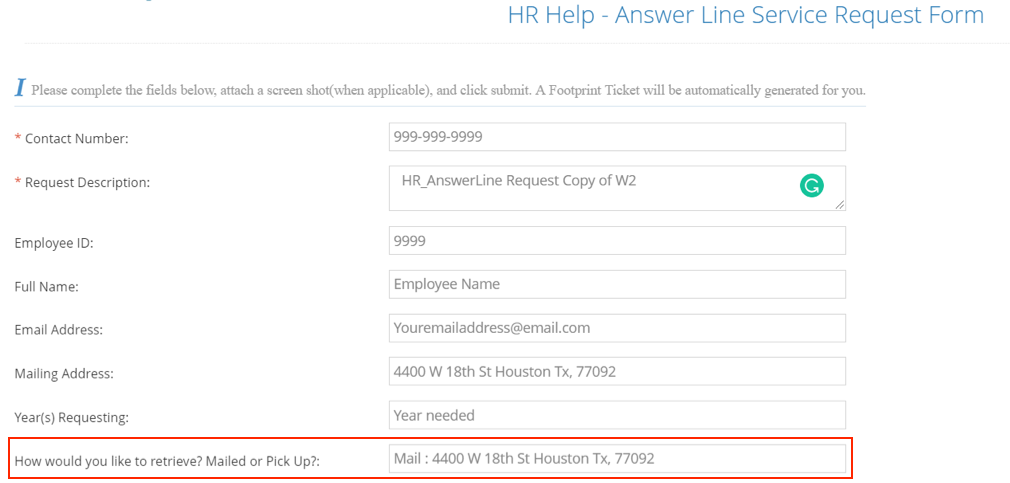

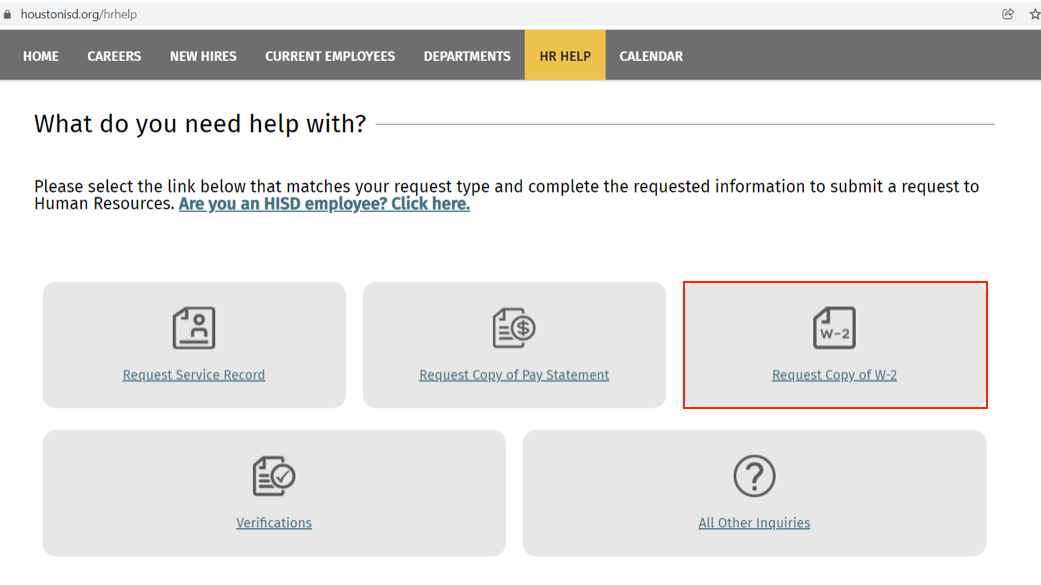

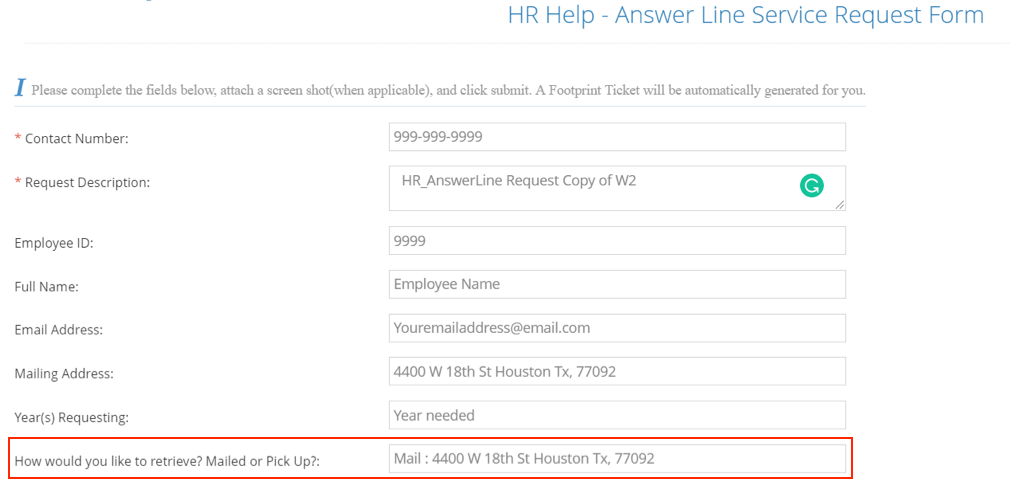

- Visit www.houstonisd.org/hrhelp and select Request Copy of W-2.

- If you are requesting for your W-2 to be mailed, please provide your address to include your full Street Address, City, State, and Zip Code.

- If you are requesting to retrieve your W-2 from our office, reprints will be released starting the week of February 3, 2025. Please provide an accurate email address and contact number and an Employee Services Associate will contact you to schedule an appointment.

- In addition, please review your personal profile by OneSource, Employee Self Service to update your address. Log in to your Employee Self-Service (ESS) account by clicking the following link: HISD ESS and select Personal Profile.

- Select the pencil tool, update your address and phone number, and click save.

I selected the option to receive my W-2 by mail. Will I have the option to view my W-2 online also?

No. By selecting the option to receive your W-2 by mail, the electronic version will not be available for you.

What happens if I selected the option to receive my W-2 by mail, my current address is correct, but I have not received my W-2?

Your 2024 W-2 will be mailed to you by January 31, 2024. If you have not received your W-2 by this date, you must request a reprint. Reprints will be available starting the week of February 3, 2025.

Why do my wages on my W-2 not reflect my wages on my last pay statement of the year?

Your W-2 reflects your taxable earnings while your pay statement reflects your total earnings. Only your taxable earnings are being reported to the IRS. To calculate your taxable earnings, subtract your total pre-tax deductions from your total earnings. These are the earnings reported to the IRS.

Why does my W-2 not reflect my annual salary?

The fiscal year of the two components differ and for this reason the two will never reflect the same amount. Your W-2 reflects your total earnings from January 1st – December 31st of the taxable year, while your annual salary reflects your fiscal school year to date earnings, September - August.

What happens if my W-2 reflects no federal taxes withheld?

Federal taxes withheld is based on how you completed your W-4 form. Your filing status and exemptions play an important part on how your earnings are taxed. We recommend speaking with your tax preparer or a Certified Public Accountant for advice. You can update your W-4 anytime by accessing W4 tax withholding in OneSource, Employee Self Service. HISD ESS

Why is there a figure identified in Box #14 on my W-2?

Employers use this box to report information such as state and disability insurance taxes withheld, union dues, and health insurance premium deductions.

What is a 1095-C form?

The 1095-C form is documentation that confirms benefit coverage for the current tax year. 1095-C forms will be released February 2025 and is not required when filing your taxes.

My Social Security number is incorrect on my W-2. What should I do?

If your social security number is incorrect on your W-2, please contact Human Resources at 713-556-7400 and request to speak with a Talent Coordinator. The Talent Coordinator will assist with updating your record. Once your social security number is corrected you should contact HISD’s Payroll Department at payrolloperations@houstonisd.org to request a corrected W-2 (form W-2C). A W-2C form is used to report a correction to your original W-2 form.

What does DD mean in box #12A?

DD means cost of employer sponsored health coverage. The amount reported with code DD is not taxable.

Why is Box #13 (Retirement Plan) checked?

If the “Retirement Plan” (Box #13) is checked, special limits may apply to the amount of traditional IRA contributions you may deduct. See Pub. 590-A, Contributions to Individual Retirement Arrangements (IRAs).

INACTIVE EMPLOYEES

I am an inactive employee. When will I receive my 2024 W-2?

All inactive employees will receive their 2024 W-2 by mail. W-2’s will be mailed to the address identified on your profile as of January 3, 2025.

NOTE: Inactive employees will not have access to retrieve their W-2 electronically. Access to HISD’s network expired at separation.

I am an inactive employee. When is the deadline to update my address to ensure I receive my W-2 by January 31, 2025?

If you are an inactive employee, the deadline to update your current address to ensure receipt of your 2024 W-2 by January 31, 2025, is January 3, 2025. If this deadline is missed, a reprint can be requested by following these steps:

- Visit www.houstonisd.org/hrhelp and select Request Copy of W-2.

- If you are requesting for your W-2 to be mailed, please provide your address to include your full Street Address, City, State, and Zip Code.

- If you are requesting to retrieve your W-2 from our office, please provide an accurate email address and contact number and a Talent Coordinator will contact you to schedule an appointment.

- Log in to your Employee Self-Service (ESS) account by clicking the following link: HISD ESS.

Work Schedule

-

What is the last day of my work calendar?

Each HISD position follows a specific work calendar that outlines the required working days for employees.

How to Check Your Work Calendar:

- Visit www.houstonisd.org.

- Navigate to the Work Calendars section.

- Locate your position’s calendar to determine the last working day of your schedule.

Leave Quota Overview

-

How can I determine the amount of leave I currently have available?

How to Determine Your Available Leave Balance

Employees can check their available leave balance in OneSource Employee Self-Service (ESS) under the Leave Overview section.

Steps to View Leave Balance:

- Log into OneSource ESS.

- Navigate to "Leave Overview."

- Review Your Leave Quota Balances, which include:

Types of Leave Balances:

- SPL Carry Over Prior Year – State Personal Leave carried over from previous school years.

- SPL Advanced Not Earned – State Personal Leave advanced at the beginning of the duty schedule; unearned hours may be recaptured upon separation.

- SPL Earned – State Personal Leave earned during the current year (not available for discretionary leave).

- LPL Carry Over Prior Year – Local Personal Leave carried over from previous school years.

- LPL Advanced Not Earned – Local Personal Leave advanced at the start of the duty schedule; unearned hours may be recaptured upon separation.

- LPL Earned – Local Personal Leave earned during the current school year (not available for discretionary leave).

- Vacation Carry Over Prior Year – Vacation hours carried over from previous school years.

- Vacation Advanced Not Earned – Vacation time advanced at the beginning of a duty schedule; unearned hours may be recaptured upon separation.

- Vacation Earned – Vacation hours earned during the current school year (not available for discretionary leave).

This information ensures employees can accurately track and manage their leave throughout the school year.

-

How can I use my state and local leave?

Using State and Local Leave

Employees may use their state and local leave at their discretion, following district policies.

Steps to Request Leave:

- Log into OneSource Employee Self-Service (ESS).

- Navigate to the "Absence Request" Section.

- Submit Your Leave Request, selecting the appropriate leave type (State or Local).

- Await Approval, if required by your department or supervisor.

For questions regarding leave policies, employees should refer to the HISD Employee Handbook

-

How many days can I be absent before I must submit a doctor’s note?

-

Doctor’s Note Requirement for Absences

Per Board Policy DEC (Local), employees must provide medical certification for personal illness absences exceeding three consecutive duty days.

Acceptable Medical Certification:

- A doctor licensed under the Medical Practice Act of Texas

- A licensed chiropractor

- A Christian Scientist practitioner

- A licensed podiatrist (chiropodist)

Additional Considerations:

- If an employee’s absences become a concern or show a pattern, the principal or supervisor may request further medical verification.

For further details, employees should refer to HISD’s leave policies or contact Employee Services.

-

-

Why was my pay docked after taking leave following a holiday?

Why Was My Pay Docked After Taking Leave Following a Holiday?

Per Board Policy DEC (Local), discretionary leave is not permitted on the day before or after a school holiday.

Key Reasons for Pay Docking:

- If an employee takes leave before or after a holiday, it may result in an unpaid absence unless it qualifies as approved non-discretionary leave (e.g., medical or emergency leave with proper documentation).

- Unauthorized leave taken during restricted periods can lead to a pay deduction for the missed workday.

For additional clarification, employees should review HISD leave policies.

-

How do I cancel an absence requested through ESS that I did not take?

How to Cancel an Absence Requested Through ESS

If you requested an absence in OneSource Employee Self-Service (ESS) but did not take it, you can edit or delete the request within 30 days of the absence.

Steps to Cancel Your Absence Request:

- Log into OneSource ESS.

- Navigate to the "Leave Overview" section.

- Find the Absence Request you want to cancel.

- Click the "Pen Icon" to Edit or the "Trash Can Icon" to Delete the absence request.

This will update your leave records and ensure your absence is properly reflected.

-

I submitted my service records from my previous school district that identified my accrued state personal leave hours; however, when I review my leave account balance in OneSource, Employee Self Service (ESS) my time does not reflect.

How to Address Missing State Leave Hours in OneSource ESS

If your accrued state personal leave from a previous district is not reflected in your OneSource Employee Self-Service (ESS) leave account, follow these steps:

- Consult with Your Campus Talent Coordinator:

- Confirm whether your service records and accrued state personal leave hours were received.

- If Documentation Was Not Received:

- Contact your previous school district to request your service record with the identified accrued leave hours.

- If Documentation Was Received:

- The Talent Coordinator will review the information for accuracy.

- If needed, your leave quota will be updated accordingly.

For additional support, reach out to your campuses Talent Coordinator.

- Consult with Your Campus Talent Coordinator:

-

I submitted a voluntary resignation online, am I eligible for State Payout?

State Personal Leave and Voluntary Resignation

State Personal Leave is not paid out upon separation from HISD, including in the case of a voluntary resignation.

Key Points:

- State Personal Leave cannot be cashed out upon resignation.

- If you are moving to another school district in Texas, your State Personal Leave is transferable.

- Upon separation, you can request service records from HISD to facilitate the transfer of leave to the new district.

-

Will my Local Personal Leave be paid out when I resign from HISD?

Local Personal Leave is forfeited upon separation from HISD, including resignation.

Key Point:

- Local Personal Leave will not be paid out when you resign or separate from the district.

Miscellaneous

-

How can I change the distribution amount going to my 403B/457 annuity?

How to Change the Distribution Amount for Your 403B/457 Annuity

To change the distribution amount going to your 403B/457 annuity, follow these steps:

- Contact OMNI, the district's 403B Plan Administrator, directly at:

- Phone: 877-544-6664

- Online: Visit Omni403b.com to make changes.

For assistance or more information about your 403B/457 annuity, OMNI will be able to provide detailed support.

- Contact OMNI, the district's 403B Plan Administrator, directly at:

-

How can I submit my Public Service/Teacher Loan Forgiveness (PSLF) application?

How to Submit Your Public Service/Teacher Loan Forgiveness (PSLF) Application

To submit your PSLF application, follow these steps:

- Visit www.houstonisd.org/hrhelp.

- Select "Verifications" and then choose "All Other".

- Complete the required fields on the form.

- Attach your signed PSLF application at the bottom of the page.

- Submit your request for processing.

Processing Time: Allow 5 to 10 business days for your application to be processed.

-

How can I get my TRS 7 form completed?

How to Get Your TRS 7 Form Completed

For Active Employees:

- Contact the Retirement Storefront at (713) 695-5561 to schedule an appointment with a Retirement Representative for assistance in completing your TRS 7 form.

For Inactive Employees:

- Submit your completed TRS 7 form in person by visiting Human Resources at the Hattie Mae White Educational Building, located at 4400 West 18th Street, Houston, Texas 77092, on the first floor.

For any additional questions or assistance, please reach out to the Retirement Storefront.