Cancer and Specified Diseases

-

Supplemental coverage for major diseases

This plan includes a wellness benefit per calendar year for screening tests and provides a cash benefit for covered procedures and other care related to the diagnosis and treatment of cancer and other specified diseases. This plan pays you in addition to any other coverage you may have.You don’t need to show evidence of good health to enroll in either option.- This plan pays benefits directly to you for covered expenses resulting from the diagnosis and treatment of cancer and other specified diseases.

- 12-month pre-existing-conditions exclusion and actively-at-work provisions apply.

- You must be under age 70 to enroll.

- The cancer and specified diseases plan offers low or high coverage options.

- You can purchase group coverage to supplement your other medical coverage and help with out-of-pocket costs while being treated for cancer or one of many other specified diseases.

- This plan pays benefits directly to you for covered expenses resulting from the diagnosis and treatment of cancer and other specified diseases.

- It pays a percentage of covered expenses up to a maximum dollar limit whether you have other insurance or not.

- Some options include a wellness benefit for annual cancer screening, medications, surgeries and related hospital stays.

- This plan also covers non-medical expenses, including travel, wigs and prosthetics.

- Aflac Group administers the plan.

- No evidence of insurability is required.

For a list of plan features, see your Cancer Low or High plan certificate.

Who can enroll

You must be under age 70 and not currently diagnosed with cancer or one of the specified diseases. You cannot have been treated for internal cancer or a specified disease in the last five years and have never tested HIV-positive.

This coverage requires no evidence of insurability (EOI) for either option.

Four coverage levels

Choose between low or high coverage levels, then decide if you want to include an intensive care option. Compare details below.

With the intensive care unit rider, you receive $600 per day for every day that you or any covered person is confined in a hospital intensive care unit (ICU). This benefit is limited to 30 days per period of confinement.

You can purchase coverage for:- Employee only

- Employee + spouse

- Employee + child

- Employee + family

Pre-existing conditions

New or increased disability coverage is subject to a 3/12 pre-existing condition exclusion. If you have a condition that was treated or medically advised in the three months before your coverage effective date, you are not covered for that condition for the first 12 months.

Actively-at-work provision

If you’re not actively at work when coverage is scheduled to become effective, your coverage doesn't take effect until you complete your first day at work. Paid leave and paid vacation are not considered being actively at work.

Taking coverage with you

If you leave the district, your disability plan is convertible, unless you’re a retiree. Other exclusions may apply. For more information about conversion, click here.

Claiming benefits

If you or a covered member of your family requires a cancer screening procedure or is diagnosed with cancer or any of the specified diseases covered by your plan, send them in a claim form within 60 days, or as soon as reasonably possible.

Benefits are paid to you immediately after the claim has been received and validated. All of the benefits due are paid to you unless you assign them elsewhere.

For details, including pre-existing conditions, read your Cancer and Specified Disease Policy certificate, available here.

If you would like to review more information, click English or Spanish

Helpful resources

For more information, contact Aflac Group at 800-433-3036 between 7 a.m. and 4 p.m. weekdays, excluding holidays.

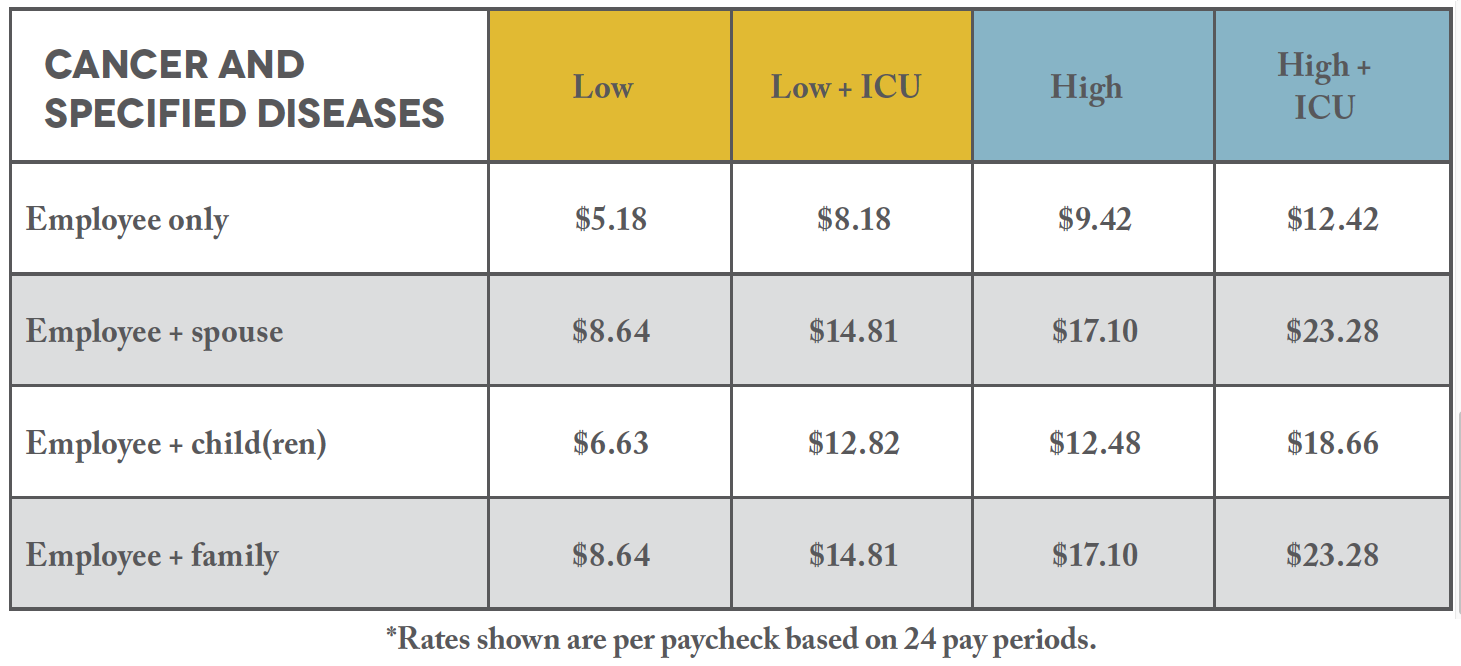

2023 COVERAGE COST

-

Cancer rates

Low option

Employee: $5.18

Employee + Spouse: $8.64

Employee + child(ren): $6.63

Employee + family: $8.64

Low option + ICU Rider

Employee: $8.18

Employee + Spouse: $14.81

Employee + child(ren): $12.82

Employee + family: $14.81

High Option

Employee: $9.42

Employee + Spouse: $17.10

Employee + child(ren): $12.48

Employee + family: $17.10

High option + ICU Rider

Employee: $12.42

Employee + Spouse: $23.28

Employee + child(ren): $18.66

Employee + family: $23.28 -

Benefit pay levels

Low option

Benefit level: $1,500

Wellness screening: $50

High option

Benefit level: $5,000

Wellness screening: $100 -

Plan features

First occurence coverage

Low option: $1,500

High option: $5,000

Wellness benefits coverage

Low option: $50/year

High option: $100/year

Hospital confinement coverage

First 30 continuous days Low option: $200/year

High option: $100/year

$200/year

Low option: $400/year coverage

High option: $600/year coverage

Surgery - inpatient/outpatient coverage

Low option: $95 - $3,000

High option: $100 - $5,000

Anesthesia

Low/High option: 25% of surgical benefit

Second surgical option coverage

Low option: $200/day

High option: $300/day

Radiation/chemotherapy coverage

Low option: $200/day

High option: $300/day

Anti-nausea medication

Low/High option: Up to $100/month

Experimental treatment coverage

Low option: Up to $200/day

High option: Up to $300/day

Blood, plasma and components coverage

Inpatient

Low option: Up to $50/day

High option: Up to $100/day

Outpatient

Low option: Up to $200/day

High option: Up to $250/day

National Cancer Institute evaluation/consultation

Low/High option: $500

Skin cancer coverage

Biopsy

Low/High option: $100

Excision of lesion of skin without flap/graft

Low/High option: $250

Excision of lesion with flap/graft

Low/High option: $600

Nursing services - in hospital coverage

Low option: $50

High option: $60

Transportation coverage

Automobile

Low option: $.40 per mile(up to $1,200 per rnd. trip)

High option: $.50 per mile(up to $1,200 per rnd. trip)

Commercial travel

Low option: $1,200

High option: $1,500

Bone marrow transplant coverage

Max in-hospital

Low/High option: $10,000

Max outpatient

Low/High option: $5,000

Bone marrow donor

Low/High option: $1,000

Stem cell transplant

High option: Incurred charges up to $2,500

Ambulance

Low/High option: Incurred charges

Prosthesis/artificial limb coverage

Surgically implanted

Low option: $2,500

High option: $3,000

Non-surgical

Low/High option: $200 coverage

Extended care facility

Low/High option: $100/day coverage

Home healthcare

Low/High option: Up to $50/day, 30 visits/year

Hospice care coverage

First 60 continuous days Low/High option: $100/day

61st day and thereafter

Low/High option: $50/day

Lifetime max per insured

Low/High option: $12,000

-

2022 Coverage Cost Comparison

Waiver of premium

Will waive premiums after 90 days of continuous disability due to cancer or covered specified disease

Specified diseases benefit

Specified diseases benefit* All of the above benefits that are available for the treatment of cancer are also available for the treatment of covered specified diseases.

Optional ICU rider

Low/High option: $600/day, up to 30 days

Covered specified diseases

Addison’s Disease

Amyotrophic Lateral Sclerosis

Cerebral Palsy

Cystic Fibrosis

Diphtheria

Encephalitis

Huntington's Chorea

Legionnaire's Disease

Malaria

Meningitis (bacterial)

Multiple Sclerosis

Muscular Dystrophy

Myasthenia Gravis

Necrotizing Fasciitis

Osteomyelitis

Poliomyelitis

Rabies

Scleroderma

Sickle Cell Anemia

Systemic Lupus

Tetanus

Tuberculosis

For a complete listing of covered specified diseases, see the plan certificates.